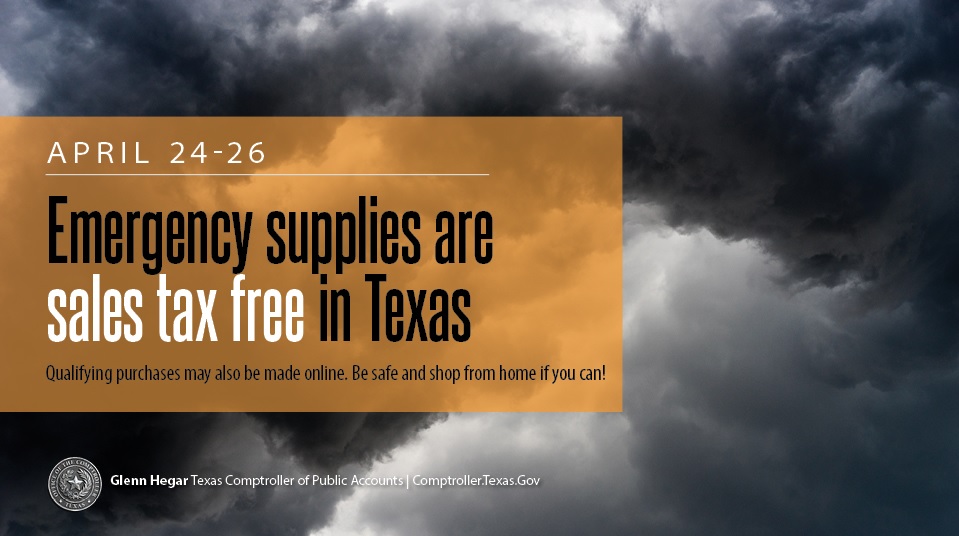

Texas Comptroller Glenn Hegar has announced another tax-free weekend. Beginning at 12:01 a.m. on Saturday, April 24, Texans can begin purchasing emergency supplies. The tax-free weekend is a direct response to the February winter storm, which left millions of people in the dark and cold.

There is no limit on the number of qualifying items you can purchase, and you do not need to give an exemption certificate to claim the exemption.

Tax-free emergency supplies include:

Less than $3000

- Portable generators

Less than $300

- Emergency ladders

- Hurricane shutters

Less than $75

- Axes

- Batteries, single or multipack (AAA cell, AA cell, C cell, D cell, 6 volt or 9 volt)

- Can openers – nonelectric

- Carbon monoxide detectors

- Coolers and ice chests for food storage – nonelectric

- Fire extinguishers

- First aid kits

- Fuel containers

- Ground anchor systems and tie-down kits

- Hatchets

- Ice products – reusable and artificial

- Light sources – portable self-powered (including battery operated)

- Examples of items include: candles, flashlights and lanterns

- Mobile telephone batteries and mobile telephone chargers

- Radios – portable self-powered (including battery operated) – includes two-way and weather band radios

- Smoke detectors

- Tarps and other plastic sheeting

Items not approved for tax-free sales include:

- Medical masks and face masks

- Cleaning supplies, such as disinfectants and bleach wipes

- Gloves, including leather, fabric, latex and types used in healthcare

- Toilet paper

- Batteries for automobiles, boats and other motorized vehicles

- Camping stoves

- Camping supplies

- Chainsaws

- Plywood

- Extension ladders

- Stepladders

- Tents

- Repair or replacement parts for emergency preparation supplies

- Services performed on, or related to, emergency preparation supplies

The tax-free weekend will continue through midnight on Monday, April 26. Purchases can be made in-store, online, or over the telephone.